Greater Toronto Area Rental Market

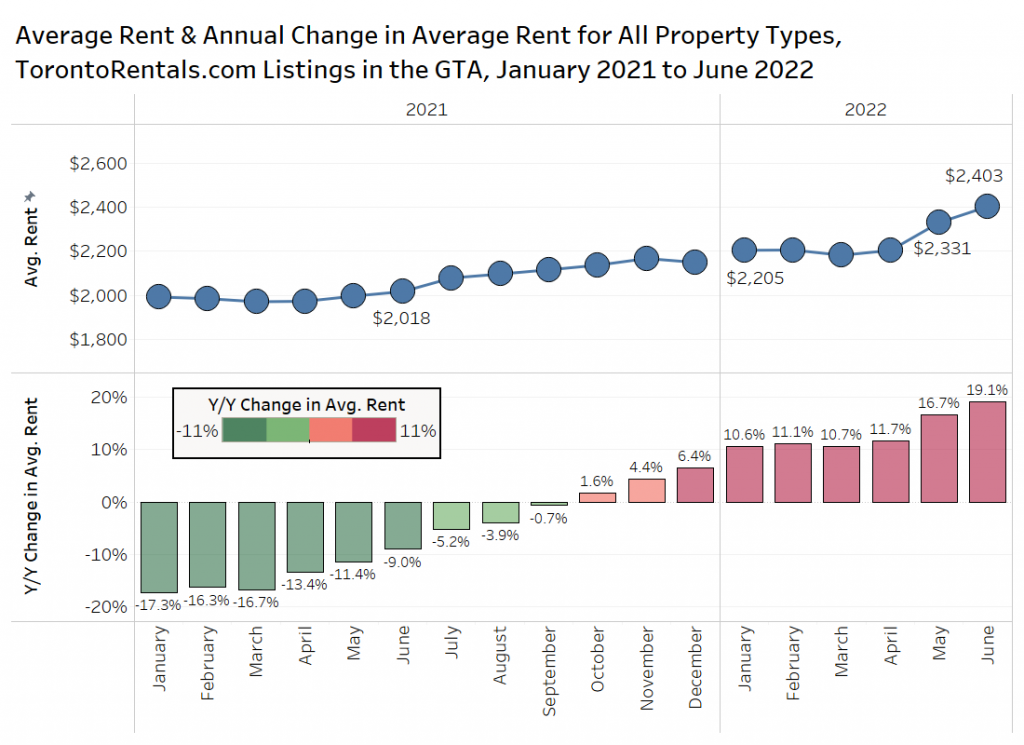

The Average Rent for All Property Types in the GTA Increased by 19% Annually in June 2022

The top panel in the chart below presents TorontoRentals.com data on the average monthly asking rent for Greater Toronto Area rental listings (all property types: basement apartments, rental apartments, condo apartments, townhouses and single-family homes) from January 2021 to June 2022.

The average monthly rental rate for all property types in June 2022 was $2,403 per month – an annual increase of 19.1% over the June 2021 average of $2,018 per month.

Following May’s 5.7% month-over-month increase, rents jumped another 3.1% in June, the second highest monthly growth rate in over three and a half years.

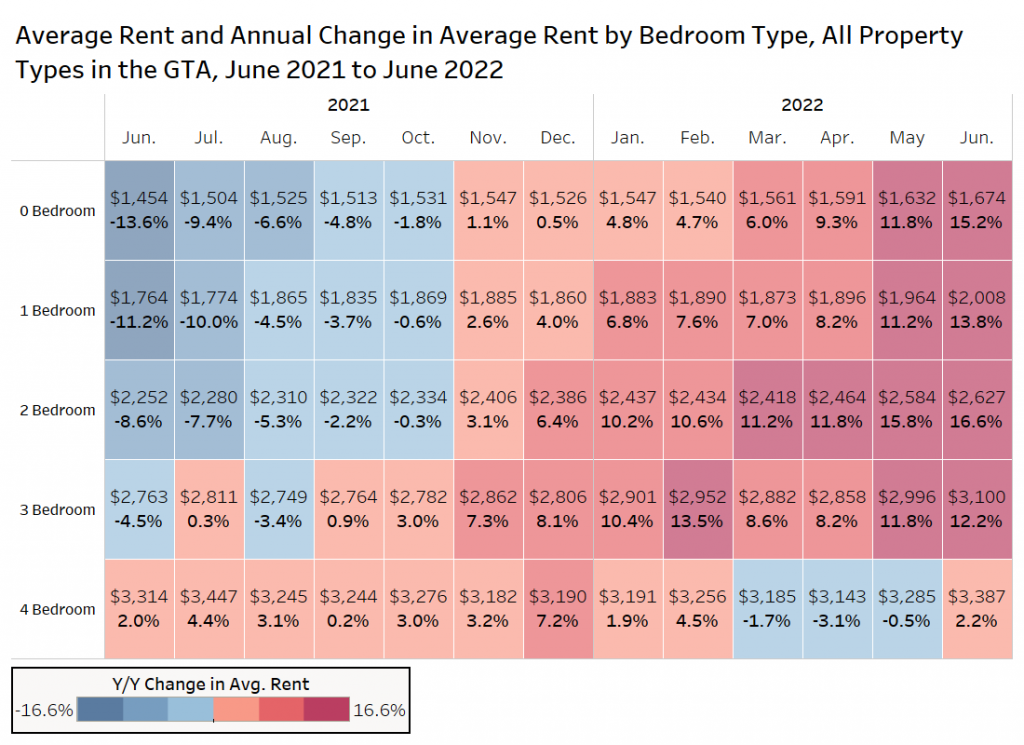

Average Rental Rates by Bedroom Type

The figure below presents the average rent and the annual change in average rent by bedroom type across all property types in the GTA between June 2021 and June 2022.

In the GTA, studio, one-bedroom, two-bedroom, three-bedroom, and four-bedroom units all experienced an annual increase in their average monthly rental rates. Two-bedroom units lead the way with an annual increase of 16.6%, with studio units close behind with an annual increase of 15.2%. Four-bedroom units experienced the smallest increase at just 2.2%.

The four-bedroom unit market segment is generally single-family homes, and the make-up of listings can often range widely from a 1,500-square-foot bungalow on a small lot in the suburbs, to a 4,000-square-foot home on a ravine lot in a prime Toronto neighbourhood. This difference in unit compositions could explain why the annual changes in rent for four-bedroom units differs so much from the rest of the market.

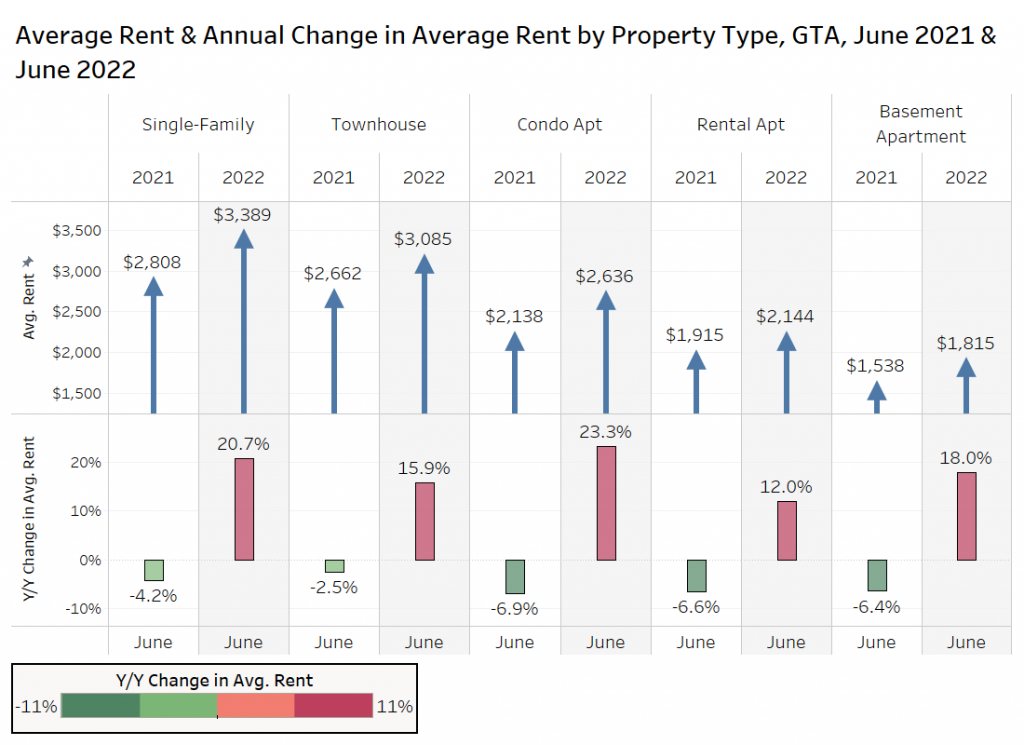

Average Rental Rates by Property Type

The next figure presents data on the average rent and the annual change in average rent by property type in June 2021 versus June 2022 via TorontoRentals.com listings data.

For each of the five property types, the average rent is higher in June 2022 than in June 2021, with the lowest annual rent inflation for rental apartments at 12%, and the highest for condo apartments at 23%. It should also be noted that in June 2021, condo apartments experienced the largest annual decline in monthly rental rate at -7%.

The average monthly rental rate for a single-family unit in June 2022 increased 21% to $3,389 per month. Townhouse units experienced an annual increase of 16% to $3,085 per month.

Even rent for basement apartments is surging, rising by 18% year over year to $1,815 per month.

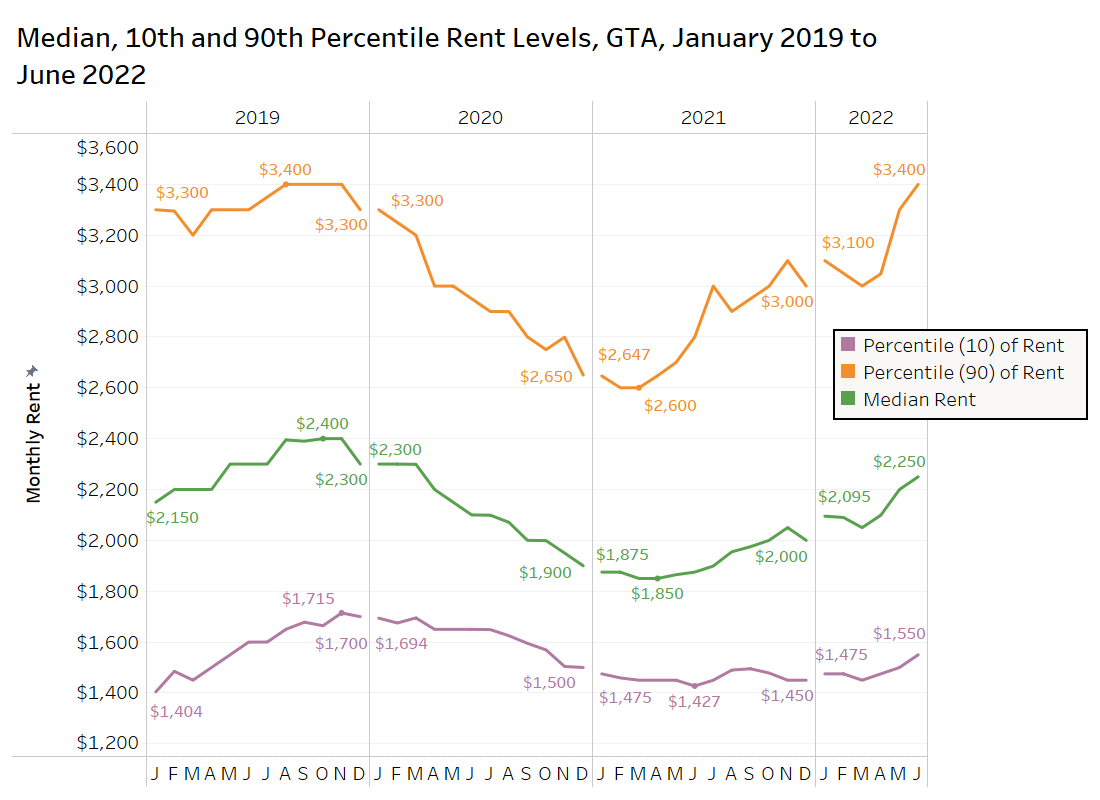

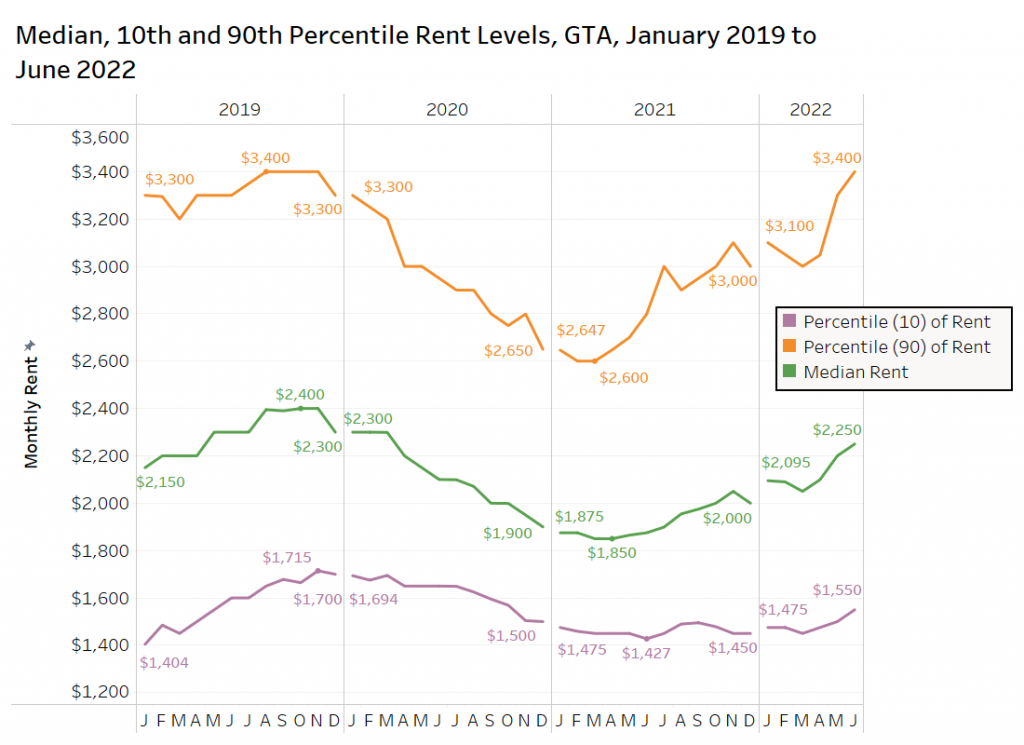

Rent by Percentiles

Parts of the market tend to move at a different rate, and looking at the 10th and 90th percentile rental rates in the GTA can provide some information on whether the luxury properties or the more “affordable” properties are seeing the most growth.

The 10th percentile data gives an indication of what is happening with the least expensive properties in the market, which shows a peak of $1,715 per month in late 2019, which was up 22% from the start of that year. 10th percentile rents then dropped 17% to $1,427 in June of last year, climbing to $1,550 in June 2022 (+9% annually).

The median rent fell 30% from the late 2019 peak of $2,400 to the early 2021 low of $1,850. Over the past year, the median rent in the GTA has increased by 20% annually to $2,250, but remains below the 2019 peak level.

The luxury rental market in June 2022 has returned to the pre-pandemic high of $3,400 per month (August to November 2019). The luxury market rents fell 31% to $2,600 in early 2021. Over the past year, the 90th percentile has climbed 21% annually.

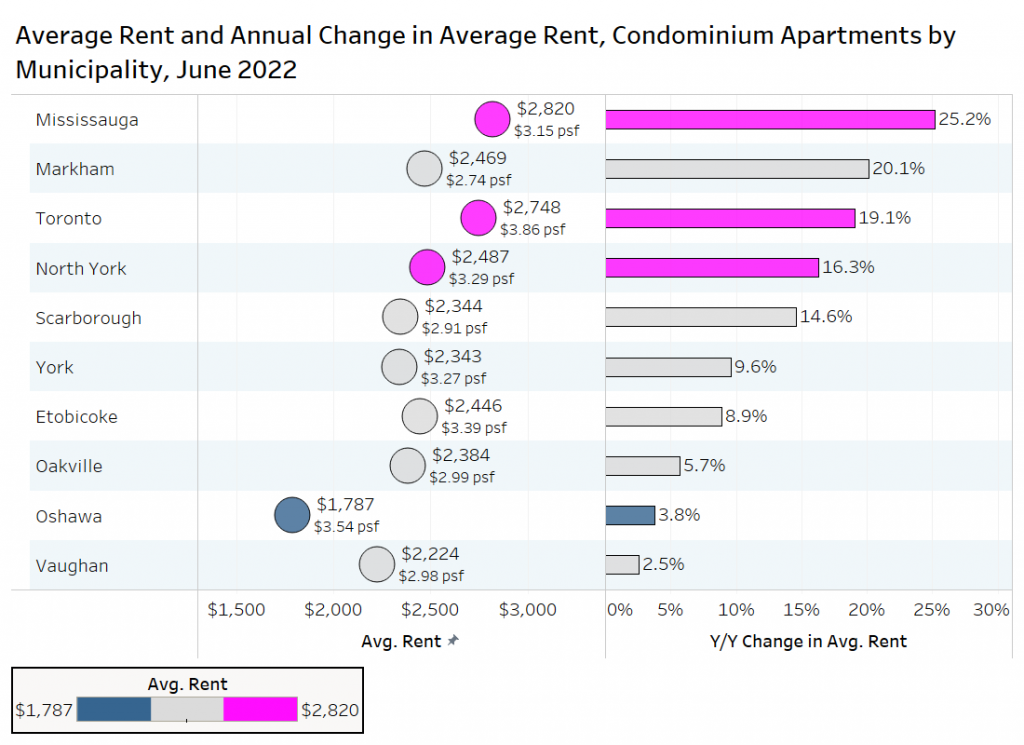

Average Rents by Municipality

The chart below looks at data on the average rent for condominium apartments in select GTA municipalities in June 2022 (Toronto is broken up into its former municipalities, prior to amalgamation).

Mississauga experienced the highest rent growth for condos in the GTA, with rents rising to $2,820 per month, a 25% annual rise and higher than average rents in the former City of Toronto.

However, Mississauga rents are higher than Toronto due to the larger average unit sizes, as the rent per-square-foot in old Toronto is $3.86, compared to $3.15 in Mississauga.

Markham experienced the second highest rent inflation year over year at 20% to $2,469 per month.

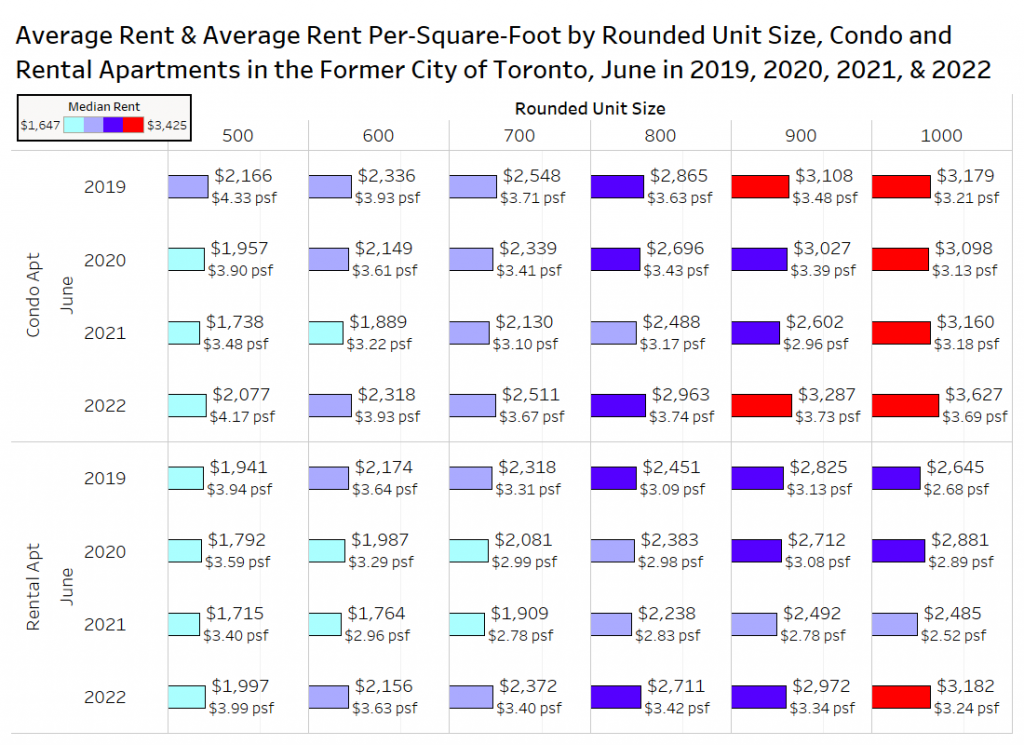

Average Rental Rates by Rounded Unit Size in Toronto

The average rent and average rent per-square-foot for condominium and rental apartments by rounded unit size is summarized in the chart below. Suites from 450 square feet to 1,049 square feet are rounded to the nearest hundred to examine the asking rents in June 2019, June 2020, June 2021, and June 2022.

In Toronto, condo units generally saw their average rental rates decline during 2020 and 2021 due to the pandemic, before rebounding strongly in 2022.

Condo units in the 1,000-square-foot rounded unit size market segment have seen their average rent move from $3,179 per month in June 2019 up to $3,627 per month in June 2022 — an increase of 14%.

However, condos rounded to 500, 600 and 700 square feet had average rents in June that are lower than their June 2019 average rent levels. Note that 600-square-foot units had identical rents of $3.93 per-square-foot in June 2019 and June 2022.

Rental apartments followed a similar trend, as the average rent also declined in 2020 and 2021 before strongly rebounding in 2022. Only 500-square-foot rental apartments are below their June 2019 rent level.

When comparing condo rents to rents at traditional apartments, the condo premium generally grows as the units get larger: 4% premium at 500 square feet, 8% at 600 square feet, 6% at 700 square feet, 9% at 800 square feet, 11% at 900 square feet, and 14% at 1,000square feet.

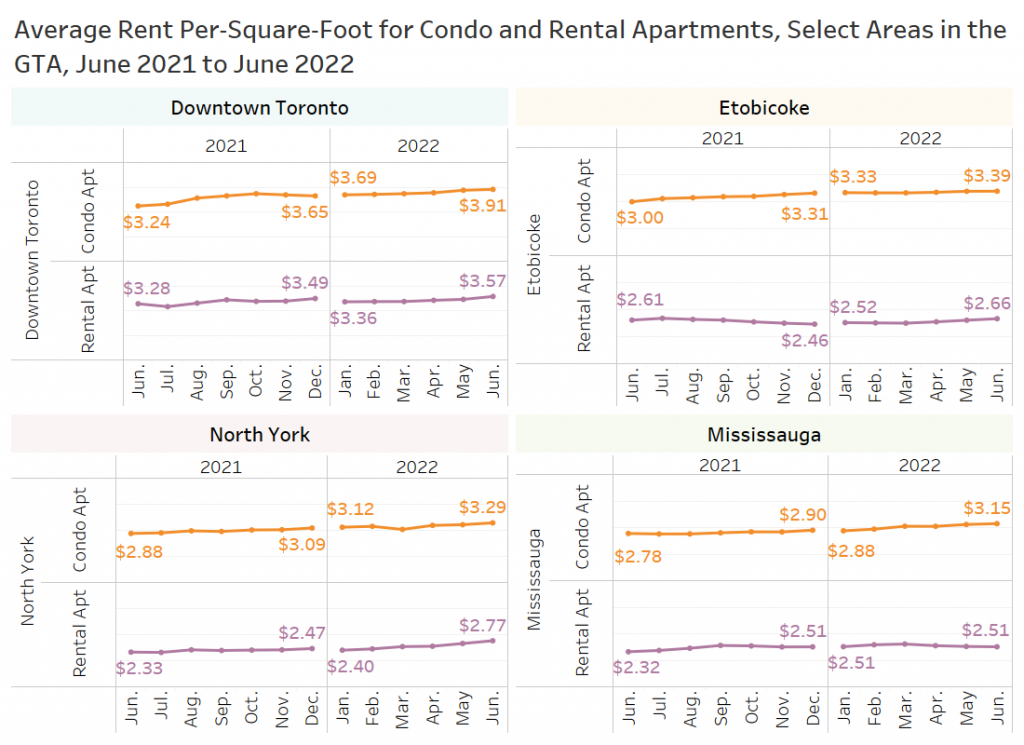

Condo and Rental Apartment Per-Square-Foot Rent Levels

The following chart looks at the average rent per-square-foot for condominium apartments and rental apartments in downtown Toronto, the former municipalities of Etobicoke and North York, and the City of Mississauga.

In downtown Toronto, the average rent per-square-foot for condo apartments has moved from $3.24 in June 2021 to $3.91 in June 2022 — an annual increase of 21%. Rental apartments have moved from $3.28 in June 2021 to $3.57 in June 2022 — an annual increase of 9%.

In Etobicoke, the average rent per-square-foot for condo apartments has moved from $3 in June 2021 to $3.39 in June 2022 — an annual increase of 13%. Rental apartments have increased 2% from $2.61 in June 2021 to $2.66 in June 2022.

The average rent per-square-foot for condo apartments in North York has moved from $2.88 in June 2021 to $3.29 in June 2022 – an annual increase of 14%. Rental apartments in North York have moved from $2.33 in June 2021 to $2.77 in June 2022 — an annual increase of 19%.

The average rent per-square-foot for condo apartments in Mississauga has moved from $2.78 in June 2021 to $3.15 in June 2022 – an annual increase of 13%. Rental apartments have moved from $2.32 per-square-foot in June 2021 to $2.51 per-square-foot in June 2022 — an annual increase of 8%. It should be noted that the average rent per-square-foot for rental apartments has not moved much throughout 2022 year to date, and was $2.51 in June 2022 (same as January 2022).

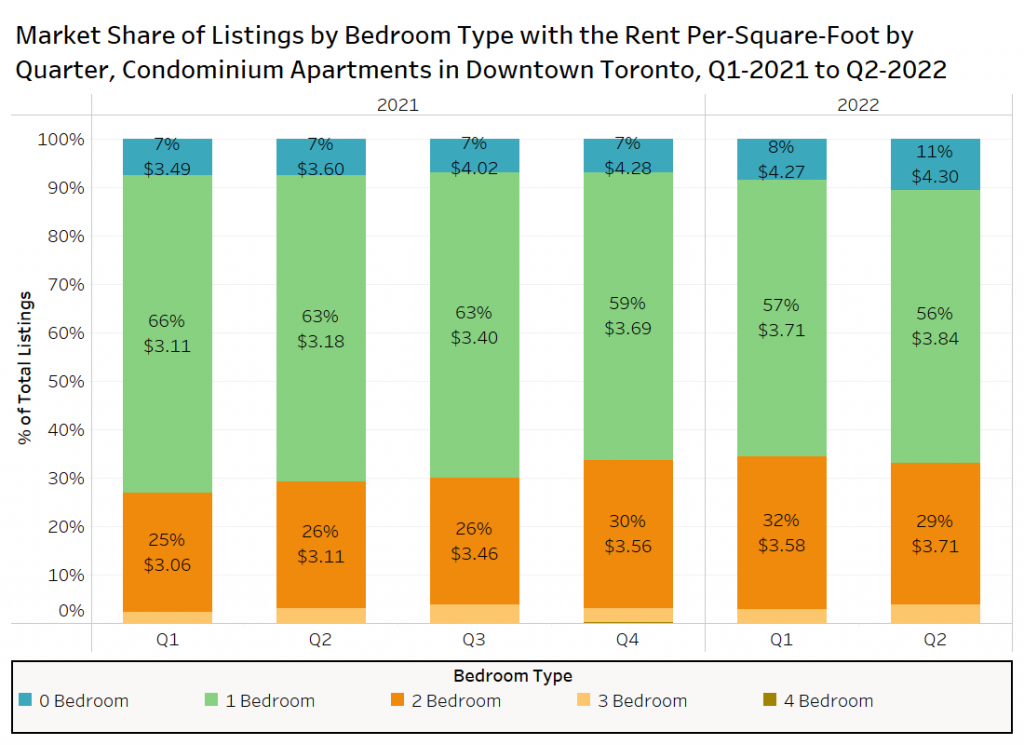

Market Share of Listings by Bedroom Type in Downtown Toronto

The chart below looks at the market share of condo apartment listings in downtown Toronto by quarter in 2021 and 2022 year-to-date.

In 2021, the percentage of condo listings on TorontoRentals.com that are studio suites has stayed largely constant, hovering around 7-8%. In Q2-2022, the percentage of studio units has increased, moving to 11% of the total listings, with rent at $4.12 per-square-foot in downtown Toronto.

The percentage of one-bedroom units has slowly declined each quarter since the start of 2021, moving from 66% of the listings in Q1-2021 to 57% of the listings in Q2-2022. Average rent for one bedroom condos has shot up as well from $3.11 per-square-foot on average in Q1-2021 to $3.84 per-square-foot in the second quarter of this year.

Two-bedroom units gradually made up more and more of the percentage of total listings throughout 2021, moving from 25% in Q1-2021 to 32% in Q1-2022. In Q2-2022, two-bedroom units slightly declined to make up 29% of the listings. Rent for two-bedroom units was $3.71 per-square-foot in the second quarter of 2022, up 19% annually.

Conclusion

The average monthly asking rent for all properties in the GTA was up 19% annually to $2,403 per month in June 2022, with much of the growth attributed to the increases in rates for smaller and medium-sized units (studio, one-bedroom, and two-bedroom units).

Following May’s 5.7% month-over-month increase in GTA rents, there was another significant rise in June of 3.1% month over month, the second highest monthly growth rate in over three and a half years.

The more expensive properties are leading the way in terms of rent growth, with the 90th percentile rent up 21% annually. Rents for all property types have gone up, but condo apartments and single-family homes lead the way with annual rent increases of over 23% and 21%, respectively.

Interest rate hikes ultimately increase the projected monthly carrying costs for prospective purchasers, leading them to put off buying a property (listings on TorontoRentals.com are down 28% from last year’s summer peak levels).

Reduced ownership demand due to higher rates typically causes house prices to decline and further disincentivizes buyers. These two factors keep renters in their properties, further reducing rental supply. There has been a return to downtowns in the post-vaccine pandemic period, which has further increased rental demand. The demand for rentals has increased due to record immigration, a surge in foreign students, and a double cohort of post-secondary graduates moving for work. This is all occurring while Ontario is seeing record out-migration to the East Coast as employees take advantage of permanent work-from-home agreements.

Inadequate new housing completions due to supply chain issues, labour stoppages, and restrictive planning policies has reduced rental supply in Toronto and the suburbs, which is a major factor in the high rent growth since April of last year.

We expect GTA rents to continue to grow for the foreseeable future, but at a slower monthly rate in comparison to the spike over the last two months.

Disclaimer

The information, statements, statistics and commentary contained within this report that was prepared by Bullpen Research & Consulting Inc. (“Bullpen”) utilized data and information from various secondary sources, as well as various discussions with industry participants. Bullpen based this report on information received or obtained, on the basis that such information is correct. Bullpen does not warrant the accuracy or completeness of the information provided or any assumptions or conclusions made by the parties that provided the information.

While Bullpen makes every effort to present accurate and reliable information in all the material as provided, Bullpen does not endorse, approve, or certify such information, nor does it guarantee the accuracy, completeness, efficacy, timeliness, or correct sequencing of such information. Use of such information is voluntary, and reliance on the information should only be undertaken after an independent review. Reference herein to any specific information, material or otherwise provided, does not constitute or imply endorsement, recommendation, or favouring by Bullpen.

Bullpen assumes no responsibility, financial or otherwise, for consequences resulting from the use of the material or information herein, or in any respect for the content of such information, including (but not limited to) errors or omissions, the accuracy or reasonableness of factual or scientific assumptions, studies or conclusions, research, the defamatory nature of statements, ownership of copyright or other intellectual property rights, and the violation of property, privacy, or personal rights of others. Bullpen is not responsible for, and expressly disclaims all liability for, damages and/or losses and/or risks, personal, professional, commercial or of any kind arising out of use, reference to, or reliance on such information. No guarantees or warranties, including (but not limited to) any express or implied warranties of merchantability or fitness for a particular use or purpose, are made by Bullpen with respect to such material and/or information. Bullpen and any sub-consultant contracted for this report make no warranty or representation regarding the results or performance that may be obtained from the use of the material or information as provided and/or regarding the accuracy or reliability of any information, or that Bullpen and the sub-consultant’s information or material will meet any user’s requirements, be uninterrupted, timely, secure or error-free. Bullpen reserves the right to change any information or material without notice or warranty.